I wasn’t surprised when the 2018 Giving USA report came out and revealed that donor-advised fund (DAF) contributions increased 27.3%. Donors placed over $29 billion in their donor-advised funds in 2017. I was surprised, however, when I discovered that more cash had been contributed to the largest donor-advised funds than had been contributed to the nation’s largest charities.

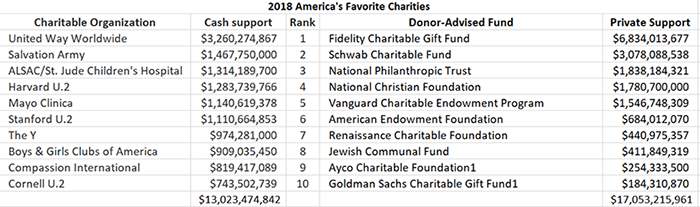

The top 10 donor-advised funds saw an influx of $17 billion, while the top 10 charities received a total of $13 billion. Today, over $110 billion in assets sit in these donor-advised fund accounts – the growth is remarkable. For comparison, in 2015 the U.S. was home to 86,203 registered foundations with assets of $890 billion. Unlike the foundation requirement to give away 5% of net asset value each year, there is no requirement for a DAF to give anything away at all!

So what are donors doing??? Some believe that donors responded to the news of the proposed tax changes and placed money in their DAF’s at the end of last year and we won’t see that type of growth again this year. Others believe we will continue to see this type of growth for years to come. Regardless, the DAF is here to stay and it would serve all organizations to understand the details and encourage advisors who are directing funds to their organization.

How to Increase Contributions from Donor Advised Funds

- Identify – Make sure you identify any donor who has advised a DAF to contribute to your charity. The hard credit will go to the fund (Schwab Charitable, Communities Foundation of Texas, etc.), but the soft credit will go to the individual advisor. One of the key attractions of a DAF is that gifts can be made anonymously, yet Fidelity indicates that only 8% of its donors make gifts anonymously. Donors seem to be happy to let you know who they are. When you receive a gift from a DAF, make sure to mark the advisor when you record the gift in your database, and reference their fund in all future communication.

- Discover – Place these donors in a philanthropy officer’s portfolio and follow your protocol for major donors. You can set up a DAF with as little as $5,000, however the average size is $284,000. Visit with the fund advisor and discover the reason for establishing the fund and the long-term desire of the donor. Discovery is ALWAYS a wonderful process – spend time actively listening to your donors…it will transform your work.

- Inspire – Because of the substantial growth of donor-advised funds over the last 10 years, it appears donors are using these charitable giving accounts for tax purposes while waiting for the right opportunity to give substantially to a cause or project they find especially motivating. Most have set up a DAF with specific charities in mind, so if you’re receiving funds, you’re on that list! They may already be giving to you through their DAF on a regular basis, but they usually have more capacity and are waiting for the right opportunity. For example, we saw substantial giving from DAF’s during disaster relief efforts. The bottom line is that donors want to be a part of something transformative. They’ve worked hard to acquire their wealth and want to give in order to “move the needle” for worthy causes. Think through your mission, analyze your unique opportunities, extract narratives of the life change occurring, and inspire donors to join the effort. They will be grateful to be a part of something bigger than themselves!

- Instruct – Giving through a donor-advised fund has become as easy as paying bills through your bank. Providing instructions to your donors will benefit you in the donation process. Understand the process of giving through the big three commercial funds: Fidelity, Schwab and Vanguard, plus your local community foundation. Then provide donors with the details on how to make a gift through each. Giving instructions with screen grabs showing the process will help donors set things up properly.

- Simplify – Answering some frequently asked questions will help clarify details for donors. For example:

- Donors who have reached the age of 70 1/2 can’t make a deposit into their DAF with their Required Minimum Distribution (RMD), but they can make a Qualified Charitable Distribution (QCD) directly to your organization;

- Donors can’t pay for a pledge or buy tickets for your gala or other events through a DAF;

- Donors can contribute appreciated stock to a DAF without paying capital gains when the stock is sold. These and other questions come up often, so set up a list of FAQ’s to help your donors make a decision.

The donor-advised fund has been around since 1931, but in the past 10 years, we’ve observed rapid growth in value as financial advisors and wealth managers have encouraged individuals on how to use them effectively to maximize tax benefits while making a significant philanthropic impact. The aging population has presented challenges to some traditional fundraising channels like direct response fundraising, telephone fundraising campaigns, even run/walk a-thons, but as your loyal donors age and decide what they will do with their accumulated wealth, one thing is certain: they like the donor-advised fund vehicle and will continue to use it for their philanthropic efforts. It’s wise to make sure your organization is prepared to work with these funds!